Third-Party Validation (TPV)

Third-Party Validation (TPV) assists merchants in verifying that users are making payment transactions using their own authorized accounts, which were provided during registration or KYC at the merchant's end.

Why it's Required?

TPV of bank accounts is a mandatory requirement for merchants in the BFSI (Banking, Financial Services, and Insurance) sector dealing with Securities, Broking, and Mutual Funds. According to Securities and Exchange Board of India (SEBI) guidelines, transactions must be made by customers only from those bank accounts that were provided during their registration with your business.

Applicability

TPV is applicable to all investment-related merchants, particularly those adhering to SEBI guidelines. Examples include:

- Broking business

- Mutual Funds

Feature Advantage

When a customer transacts using UPI TPV, their bank account number or customer relationship number (CRN) is securely connected to the transaction. This connection ensures that the payment is made only from the customer's linked UPI bank account. If the customer tries to use an account not registered, the payment will fail.

Benefits

- Transaction Authenticity: Ensures the authenticity of transactions.

- Enhanced Security: Adds an extra layer of security to payment transactions.

- Fraud Prevention: Helps prevent fraudulent transactions.

- Regulatory Compliance: Ensures compliance with SEBI guidelines.

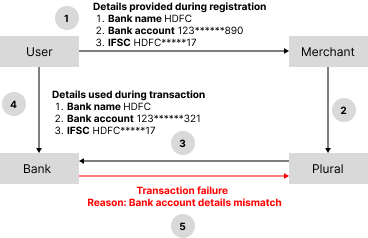

Transaction flow with TPV (Different bank accounts)

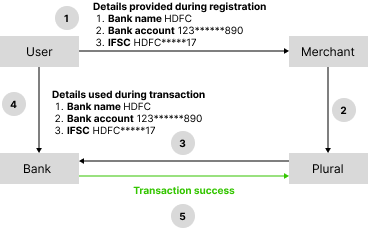

Transaction flow with TPV (Correct bank accounts)

Maximum Transaction Amount

The maximum transaction amount limit for TPV transactions on UPI remains consistent with regular (Non-TPV) UPI, set at Rs. 2 lakhs.

List of Supported Banks

For information on UPI live members and a list of banks live on UPI, refer to the NPCI website.

Settlement

Plural will transfer funds to the Merchant for all Third-Party Validation (TPV) UPI transactions following the standard Business-As-Usual (BAU → T+1) procedure.